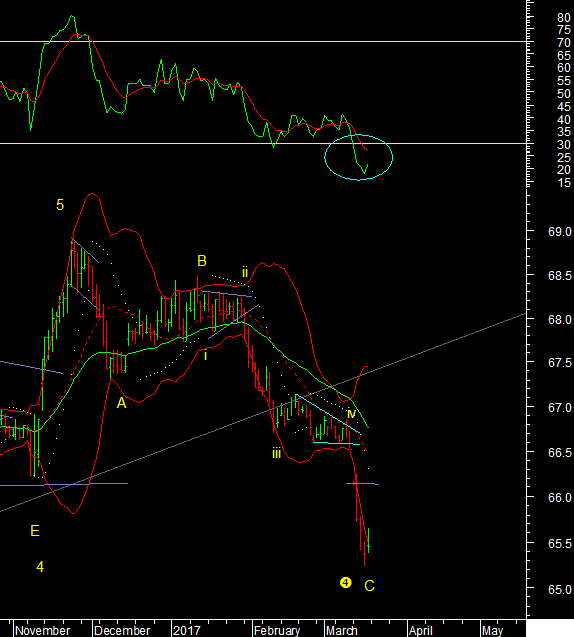

USD vs INR, GBP, BRL,JPY, TWD Technical Analysis

USDINR The daily RSI came down to 18.28, a level below 22 has been associated with many previous bottoms. You can however get a few more new lows and positive divergences before the turn around. That said USDINR closed positive and can be marked as complete as a A-B-C decline from the Nov top. Wave C just completed 5 waves down. So unless wave v of C forms an ending pattern and stretches a little lower we should have a bottom at 65.23. 65.20 is also the monthly lower Bollinger band support. USDGBP USDGBP is forming a triangle and wave E down to 0.79 is now in progress. That will complete the triangle as wave E of 4 is the last needed leg. At 0.79 we will have to look for a bottom and the start of wave 5 up as the final push for the current fractal. Will discuss it when it starts to develop USDBRL The Brazilian Real is clearly for Weak Dollar. But people are still debating it. Good. The BRL completed wave B and started wave C down. Wave C now poin