Adam Smith Associates - Will Gold Rally Further?

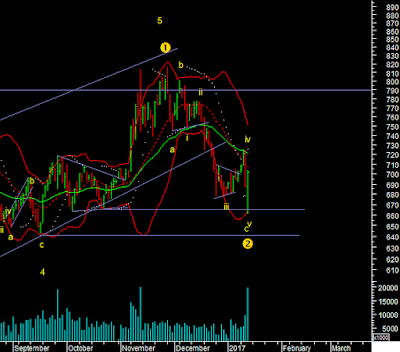

I have been of the view that Gold made a long term bottom in Dec 2015 and the fall this year is a retracement of that first rally. The Weekly Gold MCX chart below shows wave 2 completed in A-B-C and the start of wave 3 Up. Wave 3 has the implications of a move equal to wave 1 at least. 3=1=35450 as the potential level that we can achieve in a third wave rally in the next 6 months. 3rd waves can also extend where 3=1.618*wave 1 = 41000. These would be beyond the all time high of 35075 made in 2013. During the wave 2 correction Volumes were consistent with the trend i.e. declining on the way down and not rising. Volumes should expand on the way up Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article is purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd