Commodity Technical Analysis Adam Smith Associates

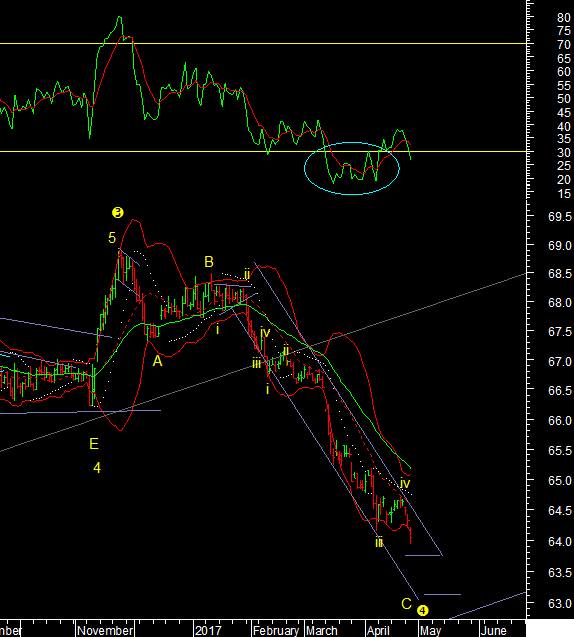

BSE Metal The BSE Metals index remains in a downtrend. The recent bounce back is facing resistance near the averages and if we break the rising trendline of the 1 year long channel then it would confirm that we head to 9500 on the index, a deeper cut in prices. A move below 10897 could be negative. Sugar NCDEX The reason to be careful about Sugar prices international is that often local agro prices do not move with the global ones in the near term. This is unlike the metals where they move in tandem. So local sugar prices did peak but did not fall with the global trend. But the wave counts still indicate lower prices on the NCDEX chart, so it might be better to wait and see what happens here before taking a stance on the sector. Copper A False Break Out The recent move up in copper was again an x wave. In many base metals I did note that either an x wave or new move is on. But I did think the flag breakout on copper could mean more. That is violated