Currency Technical Analysis Adam Smith Associates

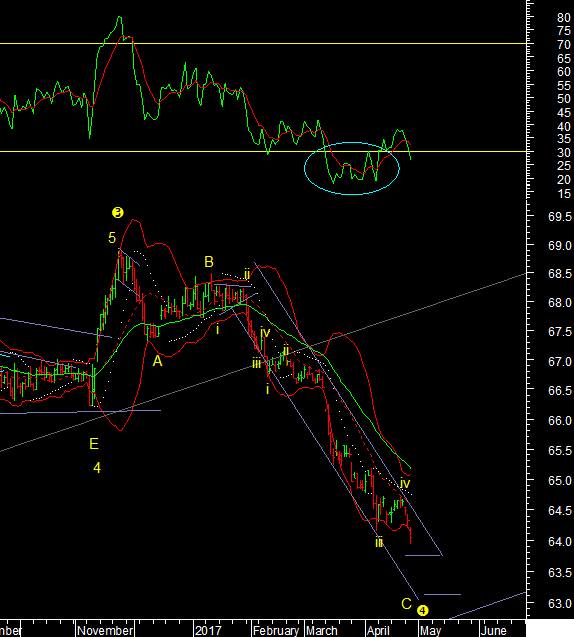

USDINR

Again gave up from the 20dma and stared to decline. Draw a falling

channel to the fall and we should be in wave v of C again with two fibonacci

targets 63.75 and 63.10, either of them could support a bottom. A move above

the 20dma would however be the final confirmation as it has been the key

resistance zone.

EURO

The Euro paused after a 5 wave advance from the April bottom. What may occur

is a near term retracement of this rise before the trend up continues. The size

of a pullback is hard to gauge right away. A move above the recent high of

1.095 would mean we are extending higher anyway. 1.08 would be the 38.2%

retracement support which is just at the big gap up area. Gaps can act as

important supports in an uptrend.

USDCNY

While the dollar has been falling the Chinese Yuan has spent months

consolidating into a triangle which is typically a 4th wave. I was anticipating

a larger degree wave 4 formation but this seems like a lower degree case. Point

being that it maybe set up for a new move. USDCNY may now rise again towards

the upper channel line near 7.12

USDAUD

I have spent a year being bearish on the dollar, In case of EM and Commodity

currencies that was mostly true. But recently we are seeing the dollar rally

and go up on these pairs even as the dollar index is near a low. So I am going

back to considering my original views on these pairs. In case of the USDAUD I

was expecting a 4th wave and on the monthly chart. The monthly momentum is back

to zero and prices are near the lower Bollinger Band. Prices made a triple

bottom near 1.290. The implications are that wave 5 up has stared from here.

5=1 on this weekly chart below is at 1.54. That is a 20% move for the pair.

Prices are back in the broader rising channel and the daily and weekly momentum

are in buy mode.

Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd