Commodity Technical Analysis By Adam Smith Associates

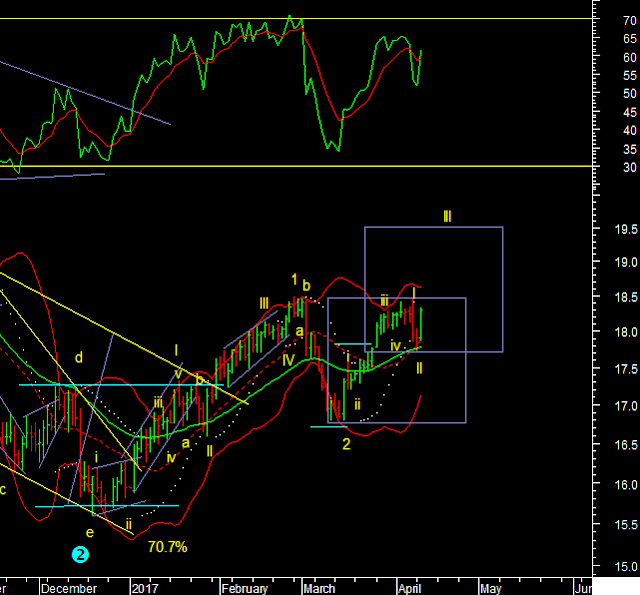

Silver

Silver took support

on the averages [19.71] and may have started wave III of 3 up. The fractal

points to 19.54$ for this move. Support is also at halfway of yesterdays large

trading day near 18$.

Gold Running Flat Consolidation Done

Gold - was in a

corrective consolidation pattern that made higher bottoms for the last several

days. This kind of correction is rare and because it occurs within a rising

trend is called a running flat. In this case it fits a rising channel as shown

on the chart. It is also a sign of strength in the underlying trend. Staying

above the upper end of the channel at 1272 we are in wave iii of 3 that points

to 1327 in the coming days

Zinc MCX

I have to come to

their conclusion that wave 5 ended for many base metals because we are getting

deeper retracements. I have already published lower levels for copper and

Nickel recently. Zinc I believed that wave 5 made a lower top [called

truncated], so it would be wave 1 of 5 and may extend but that was not the

case. I have to accept bad judgement. Wave 5 ended truncated and we are now

correcting a 1 year advance in price. Drawing a falling channel we get to 160,

and wave 4 of the next lower degree is at 150. Both are levels that can be

achieved as long as the trend is down. There maybe bounces along the way that

would improve the risk reward for trades. But we are no correcting a larger trend.

Aluminium MCX

Aluminium Prices started correcting. In my last post I imagined a triangle

that can mean wave e down to 121 before another rally. However stepping back if

I mark the bottom for the commodity in March 2016 we may have completed 5 waves

up. So a break of 121 can also mean a dip to weekly support levels of 118 and

115, and the wave 4 low is at 114.60. So these levels are open as weekly

momentum indicators are in sell mode.

BSE Metals Index

The Metals index fell

far enough to say that we have completed a 5 wave advance and wave 5 is not

extending. Now it is time for a deeper correction before the larger trend up

can resume. A dip back to wave 4 of the rise is normal and that is at 9500 for the

index from 11366, the close today. So that is a close to 20% decline from here

still on the cards before we look for a bottom. The near term chart shows a

potential head and shoulders top pattern whose neckline broke today

Sugar Prices

Global Sugar prices achieved the downside target near the lower end of the

channel where C=A. The fall in wave C may also be 5 waves and done. So we

should now start anticipating higher sugar prices in a new wave up. Mostly a

larger degree 3rd. The Caveat is that Agro prices can and have been

treacherous and so you should wait to see that wave C does not extend lower.

Look for a confirmation like a move above the averages a trendline and momentum

indicators.

Sugar NCDEX

In the morning I reported

that global sugar prices maybe ending wave C down as traded on the CSCE.

However on the NCDEX, the chart below shows that wave B may be just complete

and wave C down to 3400 or lower is still pending. I discussed this target last

month as well. Domestic prices have been lagging behind the global prices and

have a lot of catching up to do downwards. So it maybe early to call a bottom

in sugar from a domestic stand point.

Guar Gum

Guar Gum gets commodities traders interested because of its Volatility and

low floating stock that is often accused of manipulation. So Guar Gum after its

massive 2010-2012 bull run was in a bear market till last year. Mostly that is

over. The next move up may have started. New highs or not we are in an uptrend.

Wave 2 or B retraced 61.8% in early 2017 and the next move higher started. A

breakout above 8770 can trigger a move to the next swing near 13000.

Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd