Adam Smith Associates Pvt Ltd - Technical Analysis on USD v/s INR, Euro and Aluminium

Adam Smith Associates Pvt Ltd - Technical Analysis on USD v/s INR, Euro and Aluminium

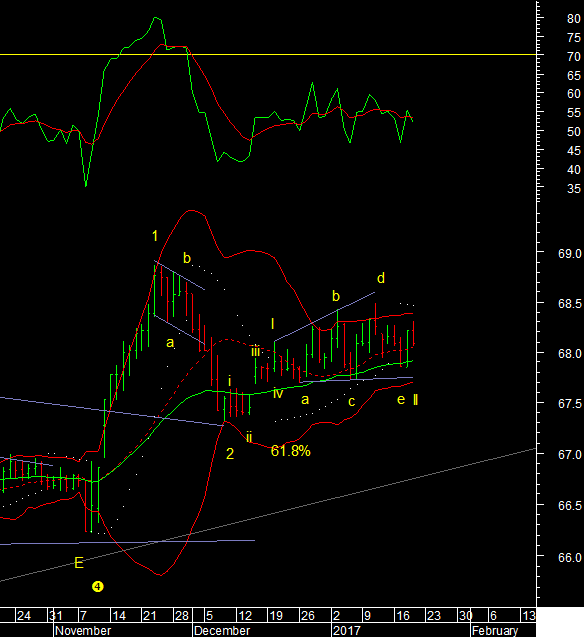

USDINR - has been in a trading range and support is at the lower end near 67.75. 67.75, is close to 61.8% of the December move and also the lower Bollinger band so it is a good support and should mostly hold. The next move up has not started but when it does we should go beyond the 68.86 high. Wave III of 3 would be the label for the next move.

Euro formed a leading diagonal, that means a rise that has the wave structure of a 5-3-5-3-5, and is therefore the first wave of a larger bullish move. The dip yesterday therefore is wave ii. With support at 1.3057 it is possible that wave ii is over. We can also get one more dip to test 1.054 before going higher but it is not a certainty. Once the next move up starts we should see it go test 1.087

Aluminium prices started their next move after making a higher swing bottom at 120.65 This move is likely to carry it to 130 in minor wave iii. This part of a larger 3rd wave advance that will take prices still higher in the weeks ahead.

Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd

USDINR - has been in a trading range and support is at the lower end near 67.75. 67.75, is close to 61.8% of the December move and also the lower Bollinger band so it is a good support and should mostly hold. The next move up has not started but when it does we should go beyond the 68.86 high. Wave III of 3 would be the label for the next move.

Euro formed a leading diagonal, that means a rise that has the wave structure of a 5-3-5-3-5, and is therefore the first wave of a larger bullish move. The dip yesterday therefore is wave ii. With support at 1.3057 it is possible that wave ii is over. We can also get one more dip to test 1.054 before going higher but it is not a certainty. Once the next move up starts we should see it go test 1.087

Aluminium prices started their next move after making a higher swing bottom at 120.65 This move is likely to carry it to 130 in minor wave iii. This part of a larger 3rd wave advance that will take prices still higher in the weeks ahead.

Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd