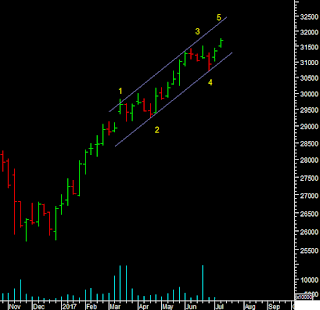

Technical Analysis of Euro, US 10 Years Treasury Notes, Commodities, CRB Index, DOW, NASDAQ, BSE 200 and DAX

EURO The Euro bull run continued even as bearish sentiment is in single digits. This excessive near term bullish traders reading continues to mean that a 5 wave rise is closer to completion. For the rally to continue unabated a pause or consolidation is needed. That said the big picture remains bullish as everyone has the narrative wrong. US 10 YEARS TREASURY NOTES The 10 year note has retraced almost 50% and wave c=a is nearly done. wave ii should be near completion and wave iii down is to unfold next soon. ------------------- COMMODITIES Gold Gold has its neckline of the lows [blue line], at 1238. So that is a key resistance level. Daily momentum did turn positive and prices broke out of the falling channel but some more signs are needed that the trend has changed to up for good. Aluminium MCX Aluminium rallied in 5 waves and retraced 61.8% at 121.70. Dipped to a low of 120.90. So these supports should help propel it into wave iii up iii=i points to 127.50 ...