Currency technical analysis adam smith associates

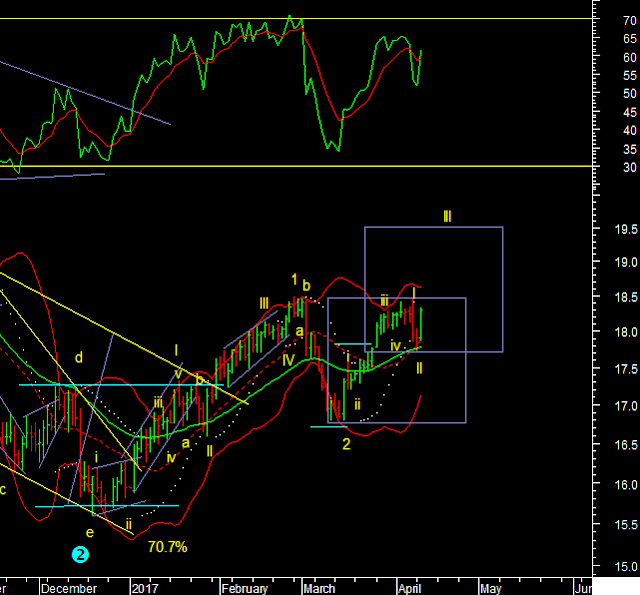

Dollar Index The dollar index sold off big today mostly on the GBP. The decline comes from a falling trendline of the tops made since Dec. This once again indicates that prices will test the lower end of the triangle as averages are already broken. This is near 98.60. However given the wave count I think this time this level should not hold, and we should break right below it and head to 96 near the wave 2 low. US 10 Years T Notes The bond market has been rallying as expected but the decline in US stocks so far feels muted. However this should change soon if the rally goes on in bonds. The pressure on US indices is visible but the decline so far is not as big as we saw in Europe. The US is waiting for its own triggers maybe. The bond rally does not appear complete in any respect so far and is likely to go on. Euro The Euro dollar remains bullish trend as today morning the wave iii high was surpassed. This makes the Euro rise impulsive and bullish. The