Commodity Technical Analysis - Gold, Copper, Soy Meal CBT, Rough Rice, Silver, Aluminium, Crude, Lead, Zinc and Soy Bean

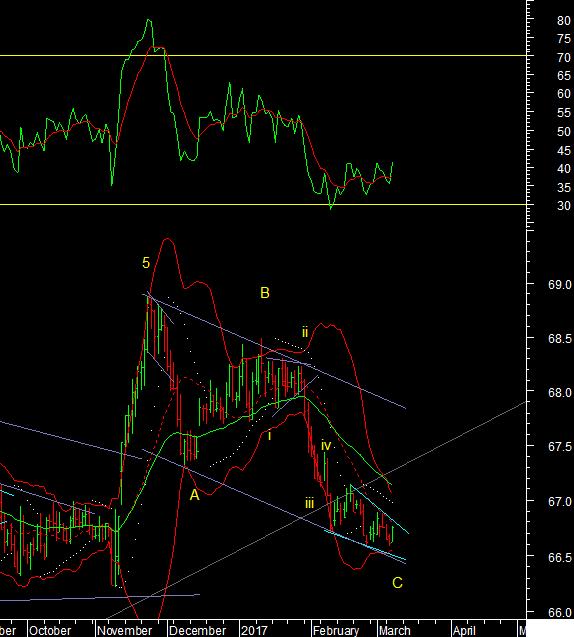

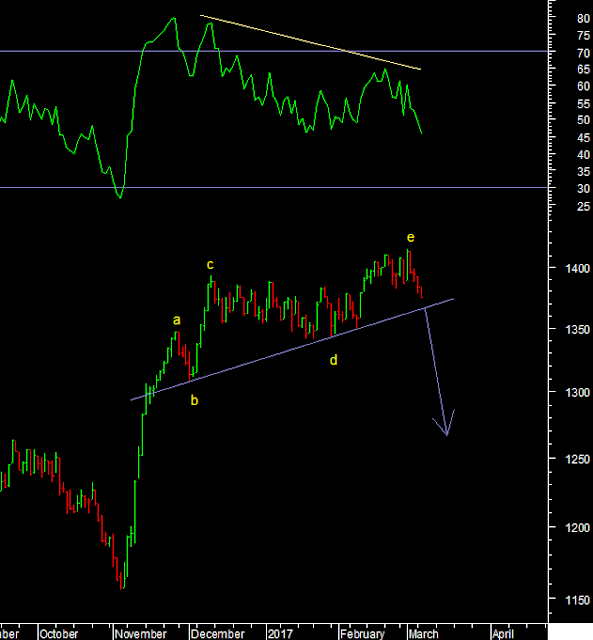

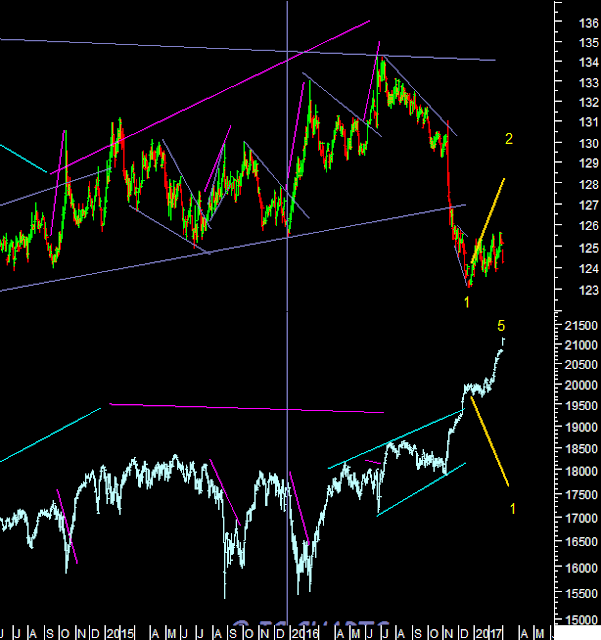

Gold The hourly chart of gold. First we had the breakout from the falling channel after 3 waves down. Then a formation of a triangle at the bottom up to yesterdays low. Wave e of the triangle has a small throw under the lower line. Triangles have occurred at both the previous bottoms in the gold price that were associated with the Fed rate hikes so this is like a pattern now. Breaking out upwards from a triangle should mean a bottom is in place. Copper Copper - sold off the highs today. It is close to the falling trendline from the highs at 2.71. The daily momentum however turned into a buy. The recent low for copper was at the 20 week average. So if prices do breakout above 2.71 it would confirm that the rally is not an X wave before another decline but the start of a move to a new high. Soy Meal (CBT) Soy Meal [CBT] prices have fallen a bit after the small push up from the FEB low. So wave III did not start, but remains due. Daily momentum is pi