Technical Analysis - USDINR, USDCNY, Euro and US 5 Years T Notes

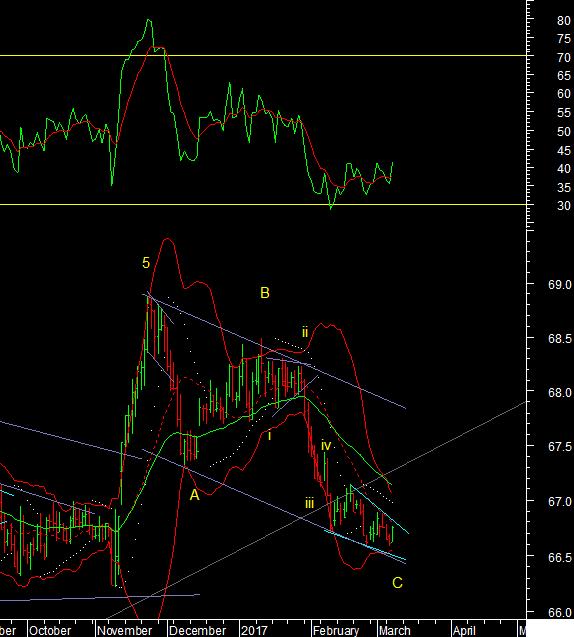

USD INR

USDINR has been falling for a while and reached the lower end of a falling

channel from the NOV top. At the recent low we have formed a ending diagonal

shown in blue. This at the lower Bollinger band with positive divergences in

the RSI and momentum in buy mode we have a set up for a bottom. Will the next

move end up being a X wave retracing the 3 month decline or the start of a

larger move up? That we will answer based on the impulsive behaviour of the

rise. 61.8% of the A-B-C fall is at 68 so that would be the initial objective.

67.12 the 40dema would be the first important resistance.

USD CNY

USDCNY - starts its

next move in wave v of III towards 7.05 at the upper end of the long term

channel

US 5 Years T Notes

US Yields made new

multi year highs today. I decided to move away from the 10/30 year charts that

I usually use because they did not give me a clear indication that we were in

wave 4. So the 5 year note was a good idea. The Monthly chart shows wave C down

developing and we are in wave 5 of C. The final wave is not over as C=A is not

yet achieved as shown by the box. So yields should keep rising for the next few

weeks. This will put pressure on most asset markets in the short term.

Euro

Euro Up Dollar Down - this view got a thumbs up by the impulsive rally late

Friday . So the Euro broke out of a falling trend after forming a ending

pattern at the lows. The Euro retraced 70.7% of wave I, in wave II. The next

move should be higher, and wave III up should test the 1.082 level.

Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd