USD vs INR, GBP, BRL,JPY, TWD Technical Analysis

USDINR

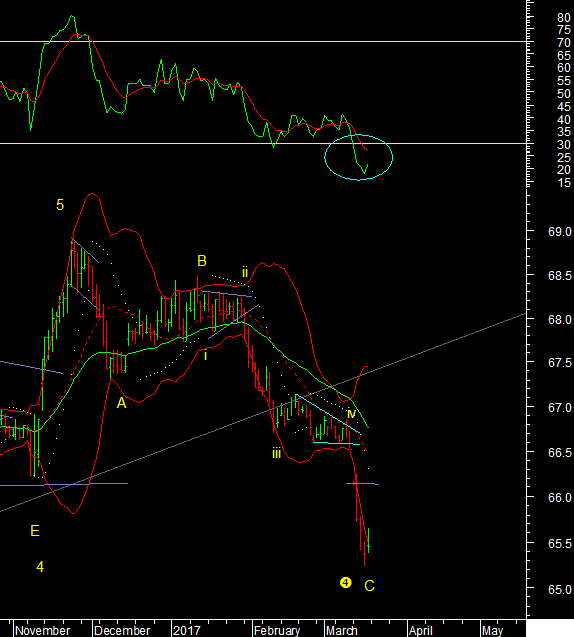

The daily

RSI came down to 18.28, a level below 22 has been associated with many

previous bottoms. You can however get a few more new lows and positive

divergences before the turn around. That said USDINR closed positive and can be

marked as complete as a A-B-C decline from the Nov top. Wave C just completed 5

waves down. So unless wave v of C forms an ending pattern and stretches a

little lower we should have a bottom at 65.23. 65.20 is also the monthly lower

Bollinger band support.

USDGBP

USDGBP is forming a triangle and wave E down to 0.79 is now in progress. That

will complete the triangle as wave E of 4 is the last needed leg. At 0.79 we

will have to look for a bottom and the start of wave 5 up as the final push for

the current fractal. Will discuss it when it starts to develop

USDBRL

The Brazilian Real is clearly for Weak Dollar. But people are

still debating it. Good. The BRL completed wave B and started wave C down. Wave

C now points to 2.778 as the next target. B was a triangle and prices did not

cross the 20 week average. Daily and weekly momentum is in sell mode.

US 30 Years Bonds

The US 30 year bonds should have now completed 5 waves down Long term and

started the Most powerful counter trend move up for the year. Early days but

the rally should continue and yields will go lower on the 10/30 year rates.

Sentiment is also poised accordingly with the readings showing even more Short

Positions now than they did at the wave 3 low in Dec among speculators, based

on CFTC Positions

USDJPY

It starts next move down in wave III and wave III points down to the

108.30 level. At a larger degree the fall from the Dec high [X] will be wave Y

down and develop into 3 waves to be marked as A-B-C. We are in A, a 5 wave

decline right now.

USDTWD - The Taiwanese dollar is in wave C down. C=A points to 29.28 in the

coming months. The falling channel would be there by end of April.

Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd