Adam Smith Associates - Euro & US 10 Years Treasury Notes Technical Analysis

Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd

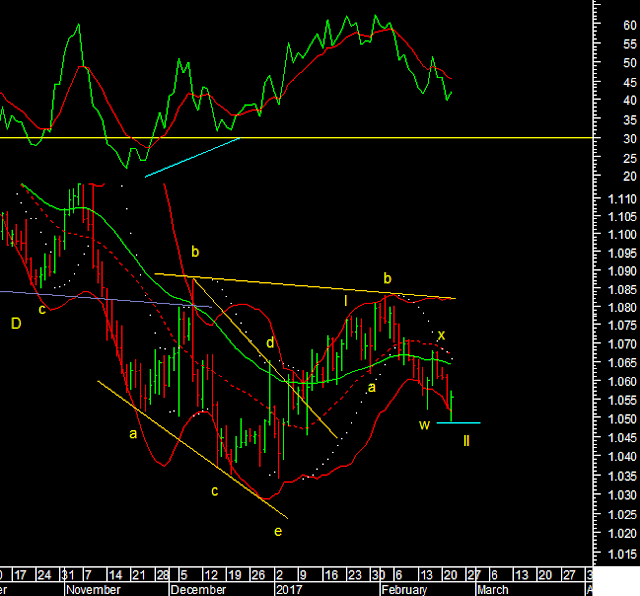

Euro

The Euro made a minor new low and bounced back. On the hourly chart its

again broken out of a falling channel for the 3 day decline. The rally for 2017

so far was wave I. So we have now retraced 70.70% of the rise in wave II. Wave

III up should be next and should test the 1.08 level.

US 10 Years Treasury Notes

US T notes rallied, as expected since December. But as you see it is a slow moving animal. So as we broke out of a inverted H&S bottom yields will fall further in the coming months. Now unlike EWI I have marked the rise as I-II-III etc of Wave A, while they are marking a-b-c and expecting an immediate decline. I am considering a prolonged rise for bonds because that is what happened the last time as well on the long term chart below after the bottom in 2013. The larger view that you wont make a new high was true but the move up was 2 years long. Bonds are slow moving animals. So even now the counter trend move up could go on for months to come, and it is better to consider it as a larger A-B-C that will take its time before the next leg down shows up.