Dollar Index Technical Analysis Adam Smith Associates

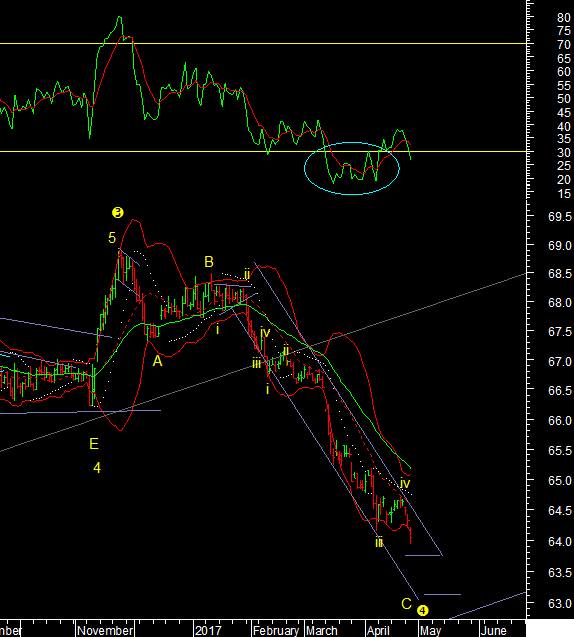

The fall in the dollar shows the potential to extend lower without major bounces. Reason is that the third wave in the fall from the April high was shorter than the first. Meaning that it can fall through the trendline of the lows at 98.50 in a single move in the next drop. The drop will be watched closely by all currency traders as it would also break the rising trendline from the May 2017 bottom. On this chart we do have a marginal close below the line but a further decline would make it crystal clear. Adam Smith Associates offers trade & commodity finance related services & solutions to its domestic & international clients. Views expressed in this article are purely of the author - Mr Rohit Srivastava - a leading technical analyst. Visit www.adamsmith.tv for services offered by Adam Smith Associates Pvt Ltd